Peak Money: a permanent change

The end of economic growth: the recession that will not end in our lifetime

- Earth energy money: past the limits to growth

- beyond capitalism and communism

- economic experts

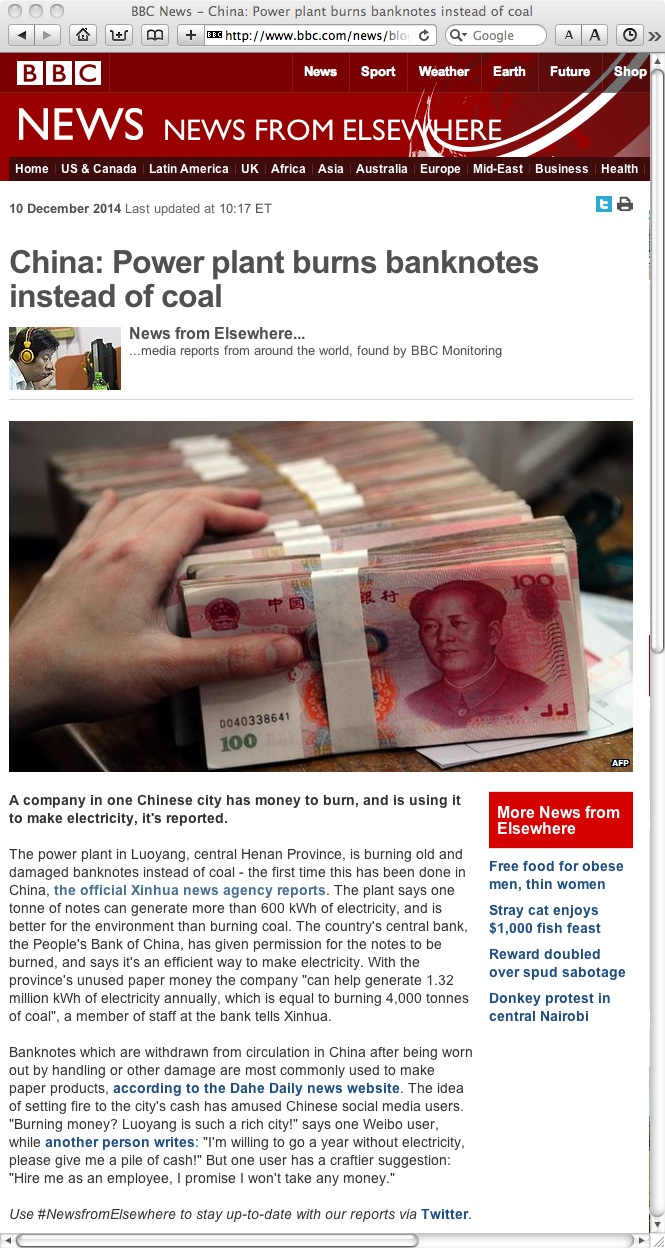

- money to burn

We are past limits to growth

Some of the media, government elites, and the financial world knew the 2008 financial crash was imminent but feigned surprise in public while planning their exit strategies and wargaming how to manage and manipulate the crisis to protect their power (not just more profits). The financial meltdown is not a cyclical recession, it is a permanent economic shift. The End of Growth transcends ideologies and partisan politics.

Now that we are at Peak Everything we need to move beyond Peak Denial and Peak Blame to equitably share the shrinking economic pie. Even if transnational corporations were converted into democratic, locally owned cooperatives, we have still overshot Earth's carrying capacity.

Steady state economics for an ecological society

The dominant paradigm teaches money is the most important value, energy conservation and ecological sanity are nice if we can afford them.

Most of the environmental movement has embraced the concept of the Triple Bottom Line, which suggests that the economy needs to consider ecology and social justice issues. While it is good to factor these into economic decisions, the deeper truth is the environment makes the economy possible. Energy creates money, not the other way around. No jobs on a dead planet.

It is probably not a coincidence that many of the political voices calling attention to the problems of fiat currency, the Federal Reserve and other structural problems rarely mention the underlying ecological limits - and worse, some of them seem fixated on Jewish bankers who allegedly run the world.

We need to weave together social justice advocates with understanding of how fiat money is created and that we have reached the limits to infinite growth on a finite planet.

The Very Big Corporation of America from Monty Python's The Meaning of Life |

www.peakchoice.org/peak-electricity.html

Renewables for a Steady State Economy by Mark Robinowitz

Using solar energy since 1990 taught me that renewable energy could only run a smaller, steady state economy. Our exponential growth economy requires ever increasing consumption of concentrated resources (fossil fuels are more energy dense than renewables). A solar energy society would require moving beyond growth-and-debt based money.

After fossil fuel we will only have solar power, but that won't replace what we use now. We need to abandon the myth of endless growth on a round, and therefore, finite planet to have a planet on which to live. Will we use the remaining fossil fuels to make lots of solar panels and relocalize food production instead of waging Peak Oil Wars?

from Extraenvironmentalist.com - interview conducted at Northwest Permaculture gathering, October 2012

permaculture design, steady state economics, peak money, solar energy, limits to growth

www.peakchoice.org/audio/interview-mark-robinowitz.mp3

15 minutes, 33 megabytes

Edward Abbey

"In the Soviet Union, government controls industry. In the United States, industry controls government. That is the principal structural difference between the two great oligarchies of our time."

-- Edward Abbey

"Industrialism, whether of the capitalist or socialist coloration, is the basic tyrant of the modern age."

-- Edward Abbey

Rosalie Bertell

"we have been confused by the struggle between communism and capitalism, which has been the dominant dialogue among thinkers for many years. This is basically a conflict over how to manage the excess in an economy. The essence of the dispute is whether accumulation of wealth should be held by government, which claims to use it for the benefit of the masses through funding of social programmes, or by private entrepreneurs, who think they can more wisely "build the economy" thereby providing jobs and a better standard of living for the people.

"The problem with both systems is that they have focused on economic stability at the expense of ecological and social stability, when it has become increasingly clear that these three are interdependent. The most urgent problem facing us at the moment is how to sustain Earth, our life-support system, not how to redistribute wealth (although I think if we learn to do the former we will be forced to recognize the wisdom of the latter)."

-- Rosalie Bertell, "Planet Earth: The Latest Weapon of War," Montreal, Black Rose Books, p. 3 www.web.net/blackrosebooks

"Anyone who believes in indefinite growth in anything physical, on a physically finite planet, is either mad or an economist." Kenneth Boulding (1910-1993)

Martin Luther King

I want to say to you as I move to my conclusion, as we talk about "Where do we go from here?" that we must honestly face the fact that the movement must address itself to the question of restructuring the whole of American society. There are forty million poor people here, and one day we must ask the question, "Why are there forty million poor people in America?" And when you begin to ask that question, you are raising a question about the economic system, about a broader distribution of wealth. When you ask that question, you begin to question the capitalistic economy. And I'm simply saying that more and more, we've got to begin to ask questions about the whole society. We are called upon to help the discouraged beggars in life's marketplace. But one day we must come to see that an edifice which produces beggars needs restructuring. It means that questions must be raised. And you see, my friends, when you deal with this you begin to ask the question, "Who owns the oil?" You begin to ask the question, "Who owns the iron ore?" You begin to ask the question, "Why is it that people have to pay water bills in a world that's two-thirds water?" These are words that must be said.

Now, don't think you have me in a bind today. I'm not talking about communism. What I'm talking about is far beyond communism. My inspiration didn't come from Karl Marx; my inspiration didn't come from Engels; my inspiration didn't come from Trotsky; my inspiration didn't come from Lenin. Yes, I read Communist Manifesto and Das Kapital a long time ago, and I saw that maybe Marx didn't follow Hegel enough. He took his dialectics, but he left out his idealism and his spiritualism. And he went over to a German philosopher by the name of Feuerbach, and took his materialism and made it into a system that he called "dialectical materialism." I have to reject that.

What I'm saying to you this morning is communism forgets that life is individual. Capitalism forgets that life is social. And the kingdom of brotherhood is found neither in the thesis of communism nor the antithesis of capitalism, but in a higher synthesis. It is found in a higher synthesis that combines the truths of both. Now, when I say questioning the whole society, it means ultimately coming to see that the problem of racism, the problem of economic exploitation, and the problem of war are all tied together. These are the triple evils that are interrelated.

-- Martin Luther King, Jr., "Where do we go from here?" 1967

King's last, and most radical, Southern Christian Leadership Conference (SCLC) presidential address

ASPO USA: Association for the Study of Peak Oil and Gas, USA

from the ASPO-USA Peak Oil Notes, October 29, 2009

Association for the Study of Peak Oil

www.aspousa.org

Quote of the day:

"(Steven Chu, US Secretary of Energy) was my boss. He knows all about peak oil, but he can't talk about it. If the government announced that peak oil was threatening our economy, Wall Street would crash. He just can't say anything about it."

-- David Fridley, scientist at Lawrence Berkeley National Laboratory, quoted in an article by Lionel Badal (see Peak Oil News, 10/28, item #23)

Automatic Earth

Center for the Advancement of the Steady State Economy

"A steady state economy can be compared to a mature forest ecosystem. The forest does not grow in aerial extent, but it is a complex, dynamic, and evolving system."

Colin Campbell, petroleum geologist, founder of ASPO, invented "Peak Oil" term

"Once you realize that this cheap, abundant, easy oil isn't there, that tells you that virtually every company quoted on the stock market is now overvalued."

www.aspo-ireland.org/contentFiles/newsletterPDFs/newsletter95_200811.pdf

"future historians will probably look back and see this as one of the great turning points for mankind. In short, debt has been premised on eternal economic growth based on flat-earth economic principles, without recognising that the growth depends on cheap energy that will no longer be available after the peak of oil production as imposed by Nature."

"as we move beyond the age of oil and beyond the economy that is driven by the age of oil, we enter an entirely new world - there really are frankly no experts anywhere who can come forward and say exactly what we do in this situation - it is entirely new to everybody's experience - there are no investors who can say this is a good investment in this situation, there are no politicians who can say this is how we should behave in this situation, even in a humble business way there is no business that can plan its future because every single aspect of its future is going to change and so we are left with a sort of vacuum"

-- Colin Campbell, founder of the Association for the Study of Peak Oil www.peakoil.net

quoted in "Peak Oil: Imposed by Nature"

Paddy Chayevsky

Network (film)

excerpt:

You have meddled with the primal forces of nature, Mr. Beale, and I won't have it! Is that clear? You think you've merely stopped a business deal. That is not the case. The Arabs have taken billions of dollars out of this country and now they must put it back. It is ebb and flow, tidal gravity. It is ecological balance. You are an old man who thinks in terms of nations and peoples. There are no nations. There are no peoples. There are no Russians, no east, no west, no Communists, no Third Worlds. There is only one holistic system of systems. One vast and immane, interwoven, interactive, multi-variant, multi-national dominion of dollars; Petrol-dollars, electro-dollars, Yens, Pounds, Rubles and sheckles. It is the international system of currency which determines the totality of life on this planet. That is the structure of the world today. That is the atomic, and sub-atomic, and galactic structure of things today. And you have meddled with the primal forces of nature, Mr. Beale, and you will atone. Am I getting through to you, Mr. Beale?

You get up on your twenty-one inch screen and howl about America and democracy. There is no America. There is no democracy. There is only I.B.M. and I.T.T. and A.T.&T and Dupont, Dow, Union Carbide and Exxon. Those are the nations of the world today. What do you think the Russians talk about in their Council of States? Karl Marx? They sit down with their statistical decision theories, lineal programming charts, and their Mini-Mac solutions and compute the cost-price probabilities of their stocks and transactions, just like we do. We no longer live in a world of nations and ideologies, Mr. Beale. The world is a college of corporations, all inexorably determined by the immutable by-laws of business. The world is a business, Mr. Beale, and it has been ever since Man crawled out of the slime.

Our children, Mr. Beale, will live to see that perfect world in which there is no war or famine, oppression or brutality. One vast and ecumenical holding company for whom all men will work to serve a common profit; in which all will hold a share of stock; all necessities provided for, all anxieties tranquilized, all boredom amused.

Herman Daly

The Daly News

Where Does Inflation Hide?

By Herman Daly, CASSE Economist Emeritus – February 20, 2018

The talking heads on the media explain the recent fall in the stock market as follows:

A fall in unemployment leads to a tight labor market and the prospect of wage increases; wage increase leads to threat of inflation; which leads the Fed to likely raise interest rates; which would lead to less borrowing, and to less investment in stocks, and consequently to an expected fall in stock prices. Therefore investors (speculators) rush to sell before the expected fall in stock prices happens, bringing about the very fall expected. So the implicit conclusion is that rising wages of the bottom 90% are bad for "the economy", while an increase in the unearned incomes (lightly taxed capital gains) of the top 10% is good for "the economy". The financial news readers of the corporate media avoid making that grotesque conclusion explicit, but it is implicit in their explanation.

A wage increase, in addition to cutting into profits, is considered inflationary, and that leads the Fed to raise interest rates and choke off the new money feeding the stock market boom and related growth euphoria. But higher interest rates serve other functions, most notably to keep capital from being wasted on uneconomic projects that are financially lucrative only at zero or negative interest rates. Furthermore, positive interest rates reward savers, provide for retirement and emergencies, and even reduce the inflationary effect of consumer spending.

As long as officially measured inflation is low the Fed can keep on pushing money into the economy to finance the asset boom. But why, with so much added money has there apparently been so little measured inflation? In truth there has been a lot of inflation, but it has simply not been measured by the Consumer Price Index (CPI). Why is that? Because the new money is borrowed into existence by investors who use it mainly to buy existing assets (stocks, bonds, real estate, art, crypto-currencies, etc.) . The price of assets goes up; we have asset price inflation, but asset prices are not part of the CPI and go uncounted. Inflation occurs in asset prices rather that in consumer goods prices, leading to boom and bust cycles.

Also some inflationary pressure spills into the goods markets, but does not register directly as a price increase and thus goes uncounted. Examples are numerous. At the supermarket the price stays the same while the box of raisins gets smaller, the block of cheese shrinks, the cup of yogurt is less full, the self-checkout line becomes the only option, etc. Air fares may not go up, but seat space declines, "miles" become ever more difficult to redeem, and quality of service becomes aggressively bad. Everywhere customer service declines as recorded "answers" replace real people ("your call is important to us—please stay on the line"). Our premier newspaper, the NYT, may not raise its price but it repeats the identical articles over and over after day and in various sections of the same edition. The price to watch network TV is to endure the commercials, which keep getting longer and louder. In sum, quantitative easing has resulted in unmeasured inflation, mainly in the asset market, but also in the consumer goods market.

Economists at the Fed are not stupid – they know this. Why then do they not correctly measure inflation and stop quantitative easing and the resulting zero (or even negative) interest rates? Because increase of asset prices benefits the asset owners, the rich, while the smaller rise in the undercounted CPI hurts mainly the poor. Also, under our fractional reserve banking system new money (interest-bearing private debt) must be loaned into existence, and banks lend to those with collateral, those at the top. In a sovereign money system the new money (non interest-bearing public debt) could be spent by the Treasury into the economy at the bottom to finance public goods and real production and employment (for an explanation of sovereign money, see Positive Money. Giving private banks the right to create money, as does our fractional reserve system (that no one ever voted for), is a giant subsidy to the private banking sector. Incidentally, the Fed is owned by these member banks who profit from excessive money creation, even though it is supposed to act independently in the public interest.

FEASTA

John Michael Greer

www.resilience.org/stories/2015-06-03/the-era-of-breakdown

The problem we face today, in the United States and more broadly throughout the world’s industrial societies, is that all the institutions of industrial civilization presuppose limitless economic growth, but the conditions that provided the basis for continued economic growth simply aren’t there any more. The 300-year joyride of industrialism was made possible by vast and cheaply extractable reserves of highly concentrated fossil fuels and other natural resources, on the one hand, and a biosphere sufficiently undamaged that it could soak up the wastes of human industry without imposing burdens on the economy, on the other. We no longer have either of those requirements.

With every passing year, more and more of the world’s total economic output has to be diverted from other activities to keep fossil fuels and other resources flowing into the industrial world’s power plants, factories, and fuel tanks; with every passing year, in turn, more and more of the world’s total economic output has to be diverted from other activities to deal with the rising costs of climate change and other ecological disruptions. These are the two jaws of the trap sketched out more than forty years ago in the pages of The Limits to Growth, still the most accurate (and thus inevitably the most savagely denounced) map of the predicament we face. The consequences of that trap can be summed up neatly: on a finite planet, after a certain point—the point of diminishing returns, which we’ve already passed—the costs of growth rise faster than the benefits, and finally force the global economy to its knees.

The task ahead of us is thus in some ways the opposite of the one that France faced in the aftermath of 1789. Instead of replacing a sclerotic and failing medieval economy with one better suited to a new era of industrial expansion, we need to replace a sclerotic and failing industrial economy with one better suited to a new era of deindustrial contraction.

Growth Busters

"it's a cold political reality that today no candidate can win election on a platform that respects the laws of physics on a finite planet."

-- Dave Gardner, "Who Will Get This Economy Moving? No One," Nov 05, 2012

www.growthbusters.org/2012/11/who-will-get-this-economy-moving-no-one/

Charles Hall

Richard Heinberg, Post Carbon Institute

"The End of Growth"

www.postcarbon.org

from The End of Suburbia (2004) DVD

Chapter 8

Richard Heinberg, author, "The Party's Over"

the consequences of global oil peak for the average family may not be immediately apparent

because energy prices and the economy are so closely intertwined, that would probably result in an economic recession.

the underlying direction of events would be toward decreased economic activity because there would be less energy available to fuel economic activity

people would be wondering why we're in recession after recession and why every recession seems to be a little bit worse than the last one

it takes longer to get out of it and then we never quite get out of the recession

until finally it would come to the point after a few years where the recession would turn into an economic depression

and in this case it will be one that never ends

David Holmgren, co-originator of permaculture

David Holmgren, the co-orginator of permaculture, is author of Future Scenarios: How Communities can adapt to Peak Oil and Climate Change.

"Economic recession is the only proven mechanism for a rapid reduction of greenhouse gas emissions

... most of the proposals for mitigation from Kyoto to the feverish efforts to construct post Kyoto solutions have been framed in ignorance of Peak Oil. As Richard Heinberg has argued recently, proposals to cap carbon emissions annually, and allowing them to be traded, rely on the rights to pollute being scarce relative to the availability of the fuel. Actual scarcity of fuel may make such schemes irrelevant."

-- www.futurescenarios.org"Awareness of Climate Change by the media and general public is obviously running well ahead of awareness about Peak Oil, but there are interesting differences in this general pattern when we look more closely at those involved in the money and energy industries. Many of those involved in money and markets have begun to rally around Climate Change as an urgent problem that can be turned into another opportunity for economic growth (of a green economy). These same people have tended to resist even using the term Peak Oil, let alone acknowledging its imminent occurrence. Perhaps this denial comes from an intuitive understanding that once markets understand that future growth is not possible, then it’s game over for our fiat system of debt-based money."

-- David Holmgren, co-originator of permaculture

"Money vs. Fossil energy: the battle to control the world"

www.holmgren.com.auDavid Holmgren (co-originator of permaculture) has some of the best understanding of energy issues.

podcast February 12, 2014

http://c-realm.com/podcasts/crealm/401-psycho-social-debt-jubilee/

401: Psycho-social Debt Jubilee

KMO welcomes permaculture co-originator David Holmgren to the C-Realm Podcast to discuss two of his essays: Money Vs Fossil Energy: the Battle for Control of the World and Crash on Demand: Welcome to the Brown Tech Future. David has been tracking the onset of climate change and peak oil for many years, but he says that in recent years, largely due to the work of Steve Keen and Nicole Foss, he has come to see financial systems as the fastest moving and most volatile element in emerging global crisis. He describes why he considers the Bush administration to have been guided by a certain energy realism lacking in too many social and climate activists. Finally, he describes why he thinks that multiple generations of mass affluence has left us saddled with a psycho-social debt that will be very difficult for us to discharge."The dip in global emissions created by the 2008 global financial crisis was ignored by the climate activist community as an inconvenient truth."

"Crash on Demand: Welcome to the Brown Tech Future," by David Holmgren (co-originator of permaculture)

http://holmgren.com.au/wp-content/uploads/2014/01/Crash-on-demand.pdf

M. King Hubbert

excerpt from Richard Heinberg, "The Party's Over," pp. 91-92, discussing M. King Hubbert, the geologist who first figured out the math behind Peak Oil. Hubbert predicted in 1956 that the USA would peak around 1970, he was pilloried for this but the USA did peak in 1970. Hubbert later predicted that the world would peak in the mid 1990s, but then cautioned this might get pushed back a decade due to the oil shock of 1973, which is what happened. Hubbert initially thought nuclear power would be the post-fossil fuel solution but changed his mind and said solar energy was the answer, but this would require giving up exponential growth and learning to live within natural limits on a finite planet. -- Mark

Hubbert immediately grasped the vast economic and social implications of this information [Peak Oil]. He understood the role of fossil fuels in the creation of the modern industrial world, and thus foresaw the wrenching transition that would likely occur following the peak in global extraction rates. ...

The world's present industrial civilization is handicapped by the coexistence of two universal, overlapping, and incompatible intellectual systems: the accumulated knowledge of the last four centuries of the properties and interrelationships of matter and energy; and the associated monetary culture which has evolved from folkways of prehistoric origin.

The first of these two systems has been responsible for the spectacular rise, principally during the last two centuries, of the present industrial system and is essentially for its continuance. The second, an inheritance from the prescientific past, operates by rules of its own having little in common with those of the matter-energy system. Nevertheless, the monetary system, by means of a loose coupling, exercises a general control over the matter-energy system upon which it is superimposed.

Despite their inherent incompatibilities, these two systems during the last two centuries have had one fundamental characteristic in common, namely exponential growth, which has made a reasonably stable coexistence possible. But, for various reasons, it is impossible for the matter-energy system to sustain exponential growh for more than a few tens of doublings, and this phase is by now almost over. The monetary system has no such constraints, and, according to one of its most fundamental rules, it must continue to grow by compound interest.

Hubbert thus believed that society, if it is to avoid chaos during the energy decline, must give up its antiquated, debt-and-interest-based monetary system and adopt a system of accounts based on matter-energy -- an inherently ecological system that would acknowledge the finite nature of essential resources.

Hubbert was quoted as saying we are in a "crisis in the evolution of human society. It's unique to both human and geologic history. It has never happened before and it can't possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered."

Statements like this one gave Hubbert the popular image of a doomsayer. Yet he was not a pessimist, indeed, on occasion he could assume the role of utopian seer. We have, he believed, the necessary know-how, all we need do is overhaul our culture and find an alternative to money. If society were to develop solar-energy technologies, reduce its population and its demands on resources, and develop a steady-state economy to replace the present one based on unending growth, our species' future could be rosy indeed. "We are not starting from zero," he emphasized. "We have an enormous amount of existing technical knowledge. It's just a matter of putting it all together. We still have great flexibility but our maneuverability will diminish with time."

www.hubbertpeak.com/hubbert/monetary.htm

"Two Intellectual Systems: Matter-energy and the Monetary Culture"

(summary, by M. King Hubbert)

During a 4-hour interview with Stephen B Andrews, SbAndrews at worldnet.att.net, on March 8, 1988, Dr. Hubbert handed over a copy of the following, which was the subject of a seminar he taught, or participated in, at MIT Energy Laboratory on Sept 30, 1981.

"The world's present industrial civilization is handicapped by the coexistence of two universal, overlapping, and incompatible intellectual systems: the accumulated knowledge of the last four centuries of the properties and interrelationships of matter and energy; and the associated monetary culture which has evloved from folkways of prehistoric origin.

"The first of these two systems has been responsible for the spectacular rise, principally during the last two centuries, of the present industrial system and is essential for its continuance. The second, an inheritance from the prescientific past, operates by rules of its own having little in common with those of the matter-energy system. Nevertheless, the monetary system, by means of a loose coupling, exercises a general control over the matter-energy system upon which it is super[im]posed.

"Despite their inherent incompatibilities, these two systems during the last two centuries have had one fundamental characteristic in common, namely, exponential growth, which has made a reasonably stable coexistence possible. But, for various reasons, it is impossible for the matter-energy system to sustain exponential growth for more than a few tens of doublings, and this phase is by now almost over. The monetary system has no such constraints, and, according to one of its most fundamental rules, it must continue to grow by compound interest. This disparity between a monetary system which continues to grow exponentially and a physical system which is unable to do so leads to an increase with time in the ratio of money to the output of the physical system. This manifests itself as price inflation. A monetary alternative corresponding to a zero physical growth rate would be a zero interest rate. The result in either case would be large-scale financial instability."

"With such relationships in mind, a review will be made of the evolution of the world's matter-energy system culminating in the present industrial society. Questions will then be considered regarding the future:

- What are the constraints and possibilities imposed by the matter-energy system? human society sustained at near optimum conditions?

- Will it be possible to so reform the monetary system that it can serve as a control system to achieve these results?

- If not, can an accounting and control system of a non-monetary nature be devised that would be approptirate for the management of an advanced industrial system?

"It appears that the stage is now set for a critical examination of this problem, and that out of such inquries, if a catastrophic solution can be avoided, there can hardly fail to emerge what the historian of science, Thomas S. Kuhn, has called a major scientific and intellectual revolution."

The following is from an article entitled "King Hubbert: Science's Don Quixote," in the February 1983 issue of Geophysics magazine, by Robert Dean Clark, assistant editor:

"Hubbert has had serious health problems for several years. Both his eyesight and hearing now give him problems. But neither the ailments nor the recent adulation have eroded his zest for intellectual combat. In recent years, he has assaulted a target--which he labels the culture of money--that is gigantic even by Hubbert standards. His thesis is that society is seriously handicapped because its two most important intellectual underpinnings, the science of matter-energy and the historic system of finance, are incompatible. A reasonable co-existance is possible when both are growing at approximately the same rate. That, Hubbert says, has been happening since the start of the industrial revolution but it is soon going to end because the amount of [that the?] matter-energy system can grow is limited while money's growth is not.

"'I was in New York in the 30s. I had a box seat at the depression,' Hubbert says. 'I can assure you it was a very educational experience. We shut the country down because of monetary reasons. We had manpower and abundant raw materials. Yet we shut the country down. We're doing the same kind of thing now but with a different material outlook. We are not in the position we were in 1929-30 with regard to the future. Then the physical system was ready to roll. This time it's not. We are in a crisis in the evolution of human socienty. It's unique to both human and geologic history. It has never happened before and it can't possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered.'

"That is obviously a scenario of catastrophe, a possibility Hubbert concedes. But it is not one he forecasts. The man known to many as a pessimist is, in this case, quite hopeful. In fact, he could be the ultimate utopian. We have, he says, the necessary technology. All we have to do is completely overhaul our culture and find an alternative to money.

"'We are not starting from zero,' he emphasizes. 'We have an enormous amount of existing technical knowledge. It's just a matter of putting it all together. We still have great flexibility but our maneuverability will diminish with time.'

"A non-catastrophic solution is impossible, Hubbert feels, unless society is made stable. This means abandoning two axioms of our culture...the work ethic and the idea that growth is the normal state of life...."

During his interview with Dr. Hubbert, Mr. Andrews asked him for his updated perspective, five years later, about his comments as quoted in the article above. He said:

"our window of opportunity is slowly closing...at the same time, it probably requires a spiral of adversity. In other words, things have to get worse before they can get better. The most important thing is to get a clear picture of the situation we're in, and the outlook for the future--exhaustion of oil and gas, that kind of thing...and an appraisal of where we are and what the time scale is. And the time scale is not centuries, it's decades."

James Howard Kunstler

"This is not so much financial bad weather as financial climate change"

-- James Howard Kunstler

http://kunstler.com/blog/2011/02/next.html

All forms of government in recent times find themselves in the same predicament: the mismanagement of contraction. Too many people and too many enterprises are competing for a contracting resource base. In many poor countries it expresses itself plainly as expensive food, or no food at all for some. The expensive food part of the story is already being felt in the wealthier countries, too, but the contraction expresses itself more in terms of money - many people do not have enough, or else much less than they were used to having, and at the same time the money that does circulate seems increasingly worthless. So we have the great debate over whether the contraction is deflationary or inflationary.

That debate could not happen if money retained its essential meaning as a reliable medium of exchange, but the idea of what exactly money is, is becoming increasingly clouded everywhere as compound interest fails in the face of contraction. And as compound interest fails - in the form of loans that can't be repaid - the banking system implodes. This implosion has been artfully papered over with enough accounting tricks so that many citizens do not even perceive it as being underway.

Chris Martsenson

"The Crash Course" energy & money: indispensible introduction to the math and physics of energy / economy overshoot, very accessible - highest recommendations

www.peakprosperity.com/crashcourse

Money as Debt

Gail Tverberg

Our Finite World: Exploring how oil limits affect the economy

The thermodynamic value of money